Calculate fica and medicare withholding

Before you calculate FICA withholding and income tax withholding you must remove some types of payments to employees. In addition to the Medicare Tax there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over Adjustments to Net.

Fica Social Security Medicare Taxes Youtube

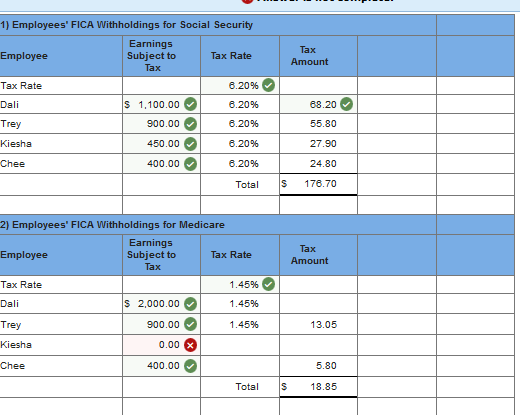

The total amount sent to the IRS for Medicare tax is 29 of taxable wages 145 employee share plus 145 employer share is a total of 29.

. The employer and the employee each pay 765. A specific formula is used when. In cell G5 calculate the gross pay based on the regular and overtime payAbrams regular pay is 398.

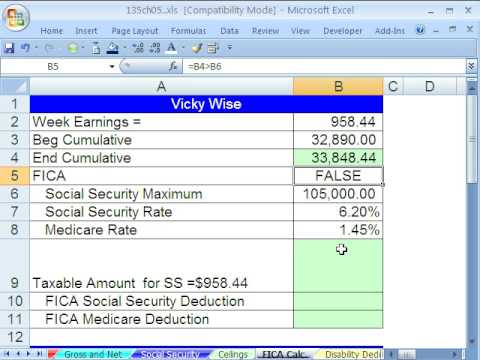

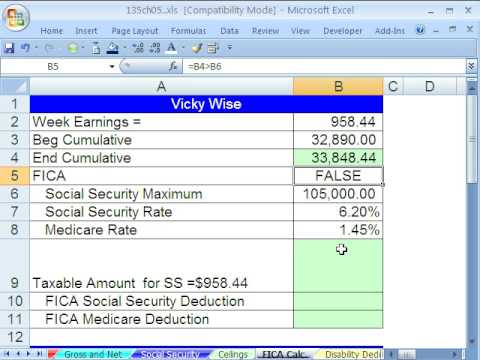

The employer and the employee each pay. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. Individuals will calculate Additional Medicare Tax liability on their individual income tax returns Form 1040 or 1040-SRusing Form 8959 Additional Medicare Tax.

Calculating FICA Medicare Tax. The current rate for. The taxable wages of Mr Richard is 900 for the week.

How Contributions are Calculated. Individuals will also report. Also known as payroll tax FICA refers to Social.

Taxes on Medicare however do not have a wage limit. How do I calculate Medicare withholding. FICA Social Security withholding Medicare withholding FICA Tax Definition Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those.

765 for the employee and 765 for the employer. Employers and employees should multiply their monthly. 145 Medicare tax withheld on all of an employees wages.

Social Security taxes total 124 and are split evenly between. For example if an employees. How do you calculate FICA and Medicare tax 2020.

The FICA for Federal Insurance Contributions Act tax also known as Payroll Tax or Self-Employment Tax depending on your employment status is your. It is subject to compensation for this tax. 5 Calculate FICA in cell J5.

With 8 overtime hours Abrams overtime pay is 11940. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. FICA taxes add up to 153 of an employees gross pay.

Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Employers are responsible for withholding the 09 Additional Medicare Tax on an individuals wages paid in excess of 200000 in a calendar year If the employee earns. 90000 x 62 5580.

62 Social Security tax withheld from the first 142800 an employee makes in 2021. Employer will deduct social security contribution would be. The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62.

FICA Tax Calculation. How to calculate FICA tax. To calculate FICA tax contribution for an employee multiply their gross pay by the Social Security and Medicare tax rates.

The employer and the.

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Payroll Calculator Google Sheets Google Sheets Getting Things Done Docs Google Com

Pin On Payroll Template

How To Calculate Fica For 2022 Workest

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Excel Busn Math 41 Payroll Deductions With Ceilings Fica Youtube

Fica Tax 4 Steps To Calculating Fica Tax In 2022 Eddy

Wyoming Child Support Computation Form Net Income Calculation Form Child Support Supportive Net Income

What Is And How To Calculate Fica Taxes Explained Social Security Taxes And Medicare Taxes Youtube

Solved Problem 11 3a Payroll Expenses Withholdings And Chegg Com

What Is Fica Tax Contribution Rates Examples

Fica Taxes Explained Social Security Medicare Tax Explained Youtube

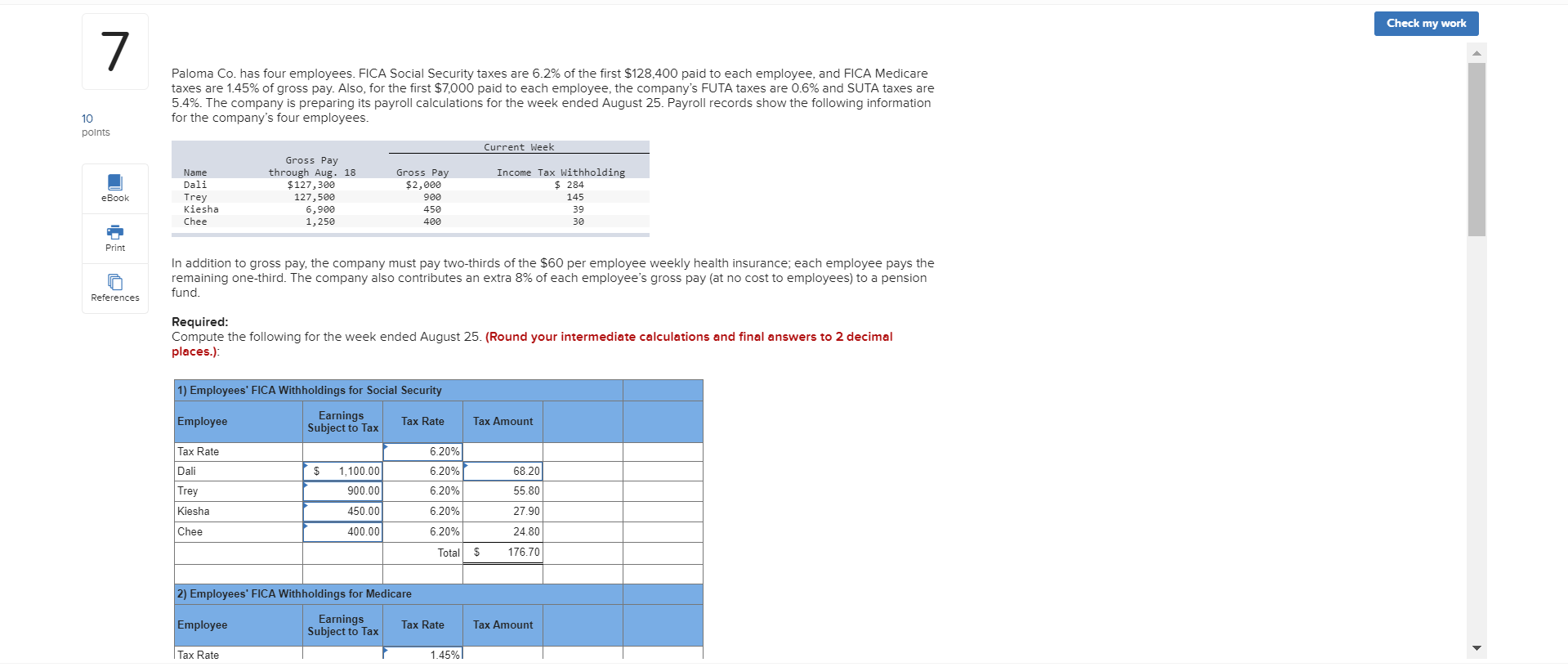

Solved Check My Work Paloma Co Has Four Employees Fica Chegg Com

Money Monday J 1 Exchange Visitors Social Security Withholding The J 1 Visa Explained

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Checks Payroll Template